tax avoidance vs tax evasion uk

Furthermore it is an illegal offence. Tackling tax evasion and avoidance.

Tax Avoidance Vs Tax Evasion What S The Difference

Magistrates court cases can sentence up to six months in jail.

. But your business can avoid paying taxes and your tax preparer can help you do that. Some practices of tax avoidance have been found to have the. What tax avoidance is.

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. Avoidance measures are very common and members of the public are often encouraged to use them by. Common tax avoidance measures.

Tax evasion and tax avoidance can be easily be confused - here are the differences and the implications if you avoid paying tax Maryse Godden 1337 8 Nov 2017. They state that more than a sixth of that amount is due to tax evasion but a further one sixth is due to tax avoidance the balance being just uncollected taxes. This document sets out the action taken this Parliament to tackle evasion and avoidance.

Tax avoidance has always created interesting news. The Home Office Annual Fraud Indicator suggested in 2011 tax evasion cost the taxpayer 15bn Annual Fraud Indicator This compares to benefit fraud of around 38bn. The maximum penalty for evading income tax is seven years of prison time or an unlimited fine.

Putting your savings into an ISA for example is one of the more commonplace methods people use to. Tax evasion is deliberately avoiding tax illegally. Well the most commonly used definition is that tax avoidance is legal while evasion is not.

It is where you deliberately break the rules and deceive the taxman about what your tax. One is illegal the other legal though arguably immoral on a larger scale. It is the illegal practice of not paying taxes not reporting income reporting illegitimate expenses or not making payment for taxes owed.

The difference with tax evasion is that it is illegal. It often involves contrived artificial. Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt.

Unlike tax avoidance tax planning is the practice of minimising tax liability with no intention of deceit. Tax planning either reduces it or does not increase your tax risk. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk.

In this respect tax evasion may be more of the low-hanging fruit given its frequency and many different forms. Of this 15bn An estimated 7 billion a year due to Evasion where individual or corporate taxpayers have deliberately omitted concealed or misrepresented. Businesses get into trouble with the IRS when they intentionally evade taxes.

On the other hand tax evasion involves deliberately. Tax Avoidance Disclosure In March 2011 the Revenue issued a document entitled Tackling Tax Avoidance which detailed how they would be approaching the problem of tax avoidance. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law.

Its as simple as that. It always creates a lot of anger and questions about how to get away with it even when the news is known. In the UK income tax evasion may result in a maximum penalty of seven years in jail or an unlimited fine.

In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities. See below for the various types of tax evasions in the UK. HM Treasury HM Revenue Customs The Rt Hon Danny Alexander.

To many people tax avoidance simply means paying as little tax as possible while remaining on the right side of the law. It is estimated that in 201920 the financial loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. You may also be on the hook for the.

As such tax evasion comes with a heftier penalty than tax fraud. In its most simplistic form there are plenty of people whose financial actions may be labelled as tax avoidance. Basically tax avoidance is legal while tax evasion is not.

It even makes big news for celebrities and large multinationals. Tax avoidance involves bending the rules of the tax system to try to gain a tax advantage that Parliament never intended. If you tell HMRC you have taken dividends of 30000 but know full well that you have actually taken 50000 or if you tell them that you have no property income when you rent a flat to tenants or say that you have no interest on savings when you have a hidden bank account then you are.

The perpetrator can be convicted for six months in jail fined up to 5000. Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway. Because there is a difference between tax evasion and tax evasion.

If you are convicted of tax evasion there can be a very large six-figure fine and a potential prison term of up to five years. Fraudsters who carried out a 100 million tax avoidance fraud have been sentenced to 27 years in prison. At the courts discretion a Magistrate may impose a penalty of up to 6 months in jail or a maximum fine of.

Avoiding Value Added-Tax VAT. In recent years concerns as to the scale of mass marketed tax. Tax evasion is ILLEGAL.

Genuine mistakes on a tax return such as misculautions and missed deadlines can also be considered tax avoidance.

Explainer What S The Difference Between Tax Avoidance And Evasion

Tax Avoidance Vs Tax Evasion Understand The Difference Youtube

What Are Tax Evasion And Tax Avoidance Taxes 101 Easy Peasy Finance For Kids And Beginners Youtube

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

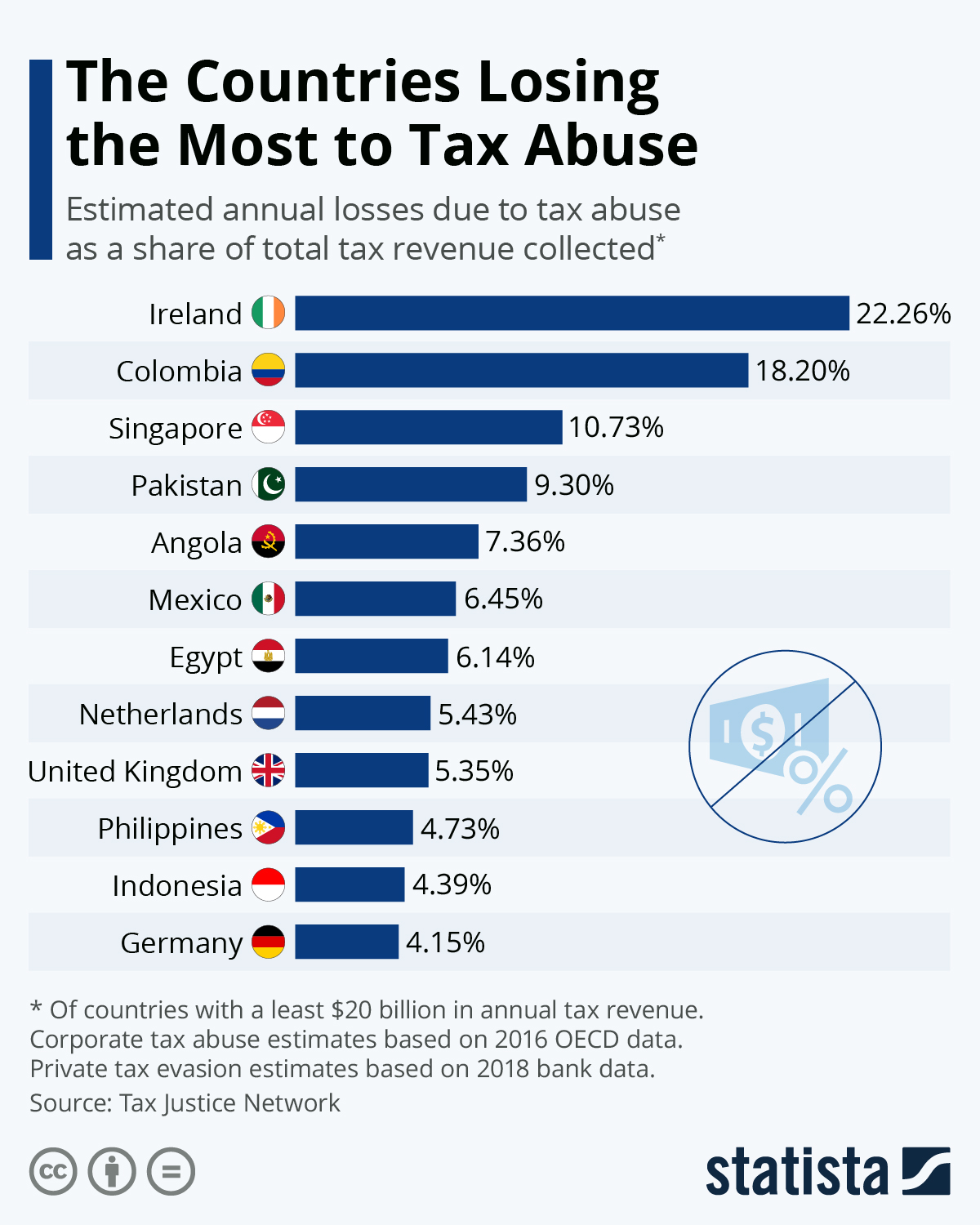

Uk Second Best At Tax Avoidance

Why It S Time To Talk About Corporate Tax Adviser Schroders

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Tax Avoidance Vs Tax Evasion Infographic Fincor

Estimating International Tax Evasion By Individuals

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Hmrc Lost 5 5bn In Tax Evasion Black Hole Over Pre Pandemic Year

Explainer The Difference Between Tax Avoidance And Evasion

Tax Evasion Statistics 2022 Update Balancing Everything

Differences Between Tax Evasion Tax Avoidance And Tax Planning